Is Jewellery a Good Investment? [A Beginners Guide]

March 17, 2018

Jewellery has been a symbol of wealth, status and social class for generations gone, as well as today.

I remember rolling my eyes inwardly whenever I heard my mother or aunts talk about buying gold, gifting gold or encouraging me to invest in some for myself. ‘It’s JUST jewellery’, I would think, ‘Gold is SO old-fashioned, anyway.’. If you’ve ever shared this experience, have you ever considered if maybe, just MAYBE, your mother was on to something?

Is jewellery a good investment? In short: yes… but there’s more to it.

Your mother was right – investing in jewellery IS a good idea. And it doesn’t just have to be gold – there are lots of other profitable options out there.

According to a report by Knight Frank, ‘investments of passion’ have been growing steadily in 2023, despite the worldwide financial crises and economic worries. Watches, jewellery and coloured diamond have grown by 18%, 16% and 4% respectively. What does this mean to us? It means investing in jewellery is a real and viable investment, with research backing its profitability.

Jewellery has been a prized asset and great investment for centuries. Many pieces are passed on as heirlooms through generations, often through the women of the families, and have been long considered a hedge fund against financial downtimes and a safety net. And it’s no surprise why this is – jewellery is a tangible, liquid asset that can be sold (or pawned) when needed, it’s easily transportable in case of emergencies and it’s increased in value at a faster pace than inflation. (This is why your mother and aunts placed so much emphasis on their gold!)

But not all jewellery is made the same. It isn’t a simple case of just purchasing what catches your fancy and hoping for the best, just because your purchase looks pretty. I always encourage women to think deeper about how they use their money and this is a prime example.

You need to make some serious considerations before taking the plunge to get the best bang out of your buck. Some things you’ll need to consider include:

- The material you’re investing in

- The kind of jewellery piece

- The expected compound annual growth rate

- The purity of what you’re purchasing

What is a compound annual growth rate?

This is a figure for how much your investment has grown, or is predicted to grow, over a specified period. This is a vital figure – we want to invest in jewellery that has a historical track record of healthy CAGR, with predictions of more growth.

Let’s take a deep dive into some of the most popular jewellery investment options on the market now, alongside a breakdown of whether they’re a wise investment for you.

The best types of jewellery to invest in

Gold

Compound annual growth rate: 11%

Gold is traditionally given as a wedding gift to daughters at their weddings in many parts of the world. This is particularly the case in many South Asian, Arab and African cultures. Many women of ethnic backgrounds may have memories of their mothers ‘saving’ or ‘collecting’ gold over the years for their marriage, giving them their own gold, or valuable heirlooms being passed on from generation to generation of females.

They were smart women – they knew the value of having a tangible, valuable asset that can be sold in the future if needs must, particularly in a society where women did not have autonomous access to money and assets aside from jewellery.

To this day, gold is one of the most profitable and ‘safest’ jewellery investments you can make, with a track record of growth that has outpaced inflation.

“When compared to other popular long-term investments, gold has long been considered a reliable option. There are many reasons for this, but primarily because the price of gold rarely decreases and is known to increase in times of economic hardship — unlike most other investments… I predict that if the country does enter a recession which is quite possible gold will rise making it a great investment long term”

Robert Cuomo, Managing Director at Hatton Jewellers.

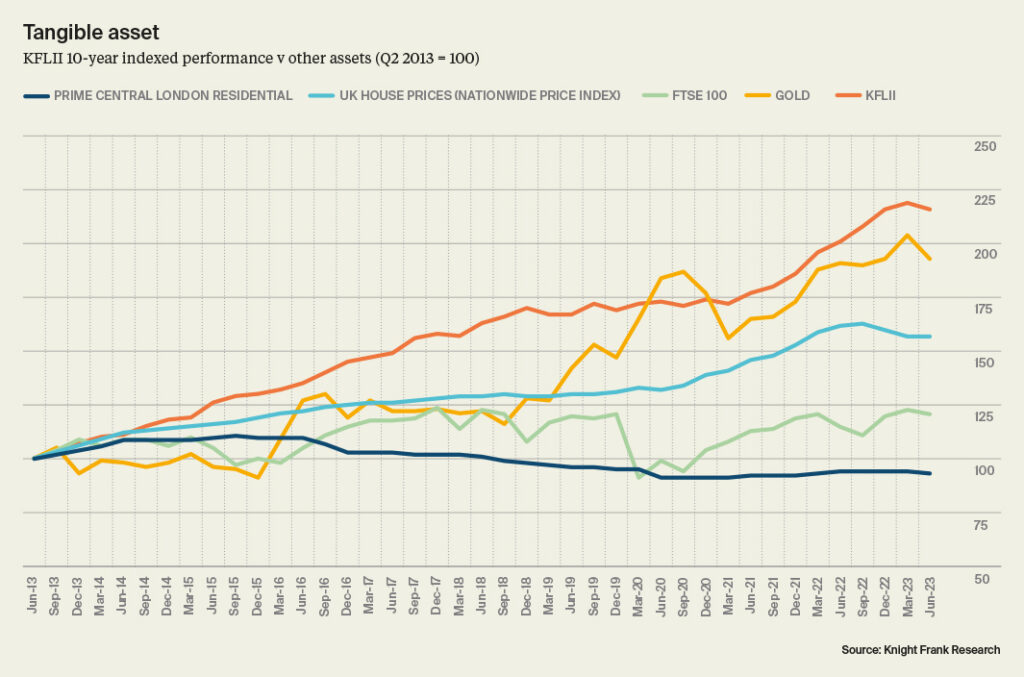

In the graph I’m sharing below by KFLII (Knight Frank Luxury Investment Index), we can see gold yields better profits than investments in FTSE 100, UK house prices and even prime Central London residential property! How’s that for a safe, impressive investment?!

Pearls

Compound annual growth rate: 13%

Pearls have recently had a modern revival of sorts, gaining more interest from the younger generation for its aesthetic and glamorous appeal. They’ve long been a big part of Japanese culture, where pearls hold deep, profound significance as an heirloom, in a similar way that gold does for South Asian, Arab and African cultures.

These reasons, alongside pearls’ inherent value, pearl jewellery is an incredibly worthwhile investment. In fact, it has an even higher compound annual growth rate than gold!

The pearl market is divided into two categories: saltwater pearl and freshwater pearl. Experts recommend natural saltwater pearls as the better investment option of the two.

Platinum

Compound annual growth rate: 5%

Platinum has seen an increase in popularity over the last few years as the middle ground between gold and silver.

Interestingly, during times of economic hardship, platinum tends to be priced twice as high as gold, whereas during periods of economic growth, platinum falls to half the price of gold [Source]. This makes it a riskier, more volatile option than gold, but with potential for high gains if moves are mode at the right times.

Diamonds

Compound annual growth rate: 3.8%

Diamonds are a slightly trickier investment option, for a number of reasons. Most significantly, they are notoriously difficult to resell. Diamonds need to go under a full analysis of diamond cut, colour, clarity, and carat before a price is set. The quality of the diamond heavily dictates its selling point, unlike gold which has its price set on pure weight. Additionally, diamonds do not have a transparent price index like gold or silver has, making it’s resell price as the whim of the markets and networks you try to sell in.

However, if you’re still keen on diamonds, here’s some interesting information. Coloured diamonds have been growing in popularity at a much faster rate than white. Natural blue diamonds and pink diamonds have shown compound annual growth rates of 7.8% and 11.2% respectively [Source], making it a significantly better option!

‘White diamond prices up a mere 3.5 per cent in ten years. If you did want to invest then a different and rarer colour may be wise. There’s been nearly a 400 per cent appreciation for pinks and more than 200 per cent for blues. Even yellow diamonds have increased by 45 per cent over the same period. In comparison, increases in values of white diamonds start from just 3.5 per cent for the same period.’

Tobias Kormind, 77 Diamond

Silver

Compound annual growth rate: 4.6%

An ounce of silver costs just over 1% the price of gold, making it an attractive entry point for beginner investors with a limited budget. Silver is now an indispensable metal for the modern age, with many uses in the medical, industrial and technological industries, so it’s a useful asset even if silver jewellery ever goes out of fashion (which to be honest, is unlikely).

However, silver is a lot more volatile than gold – 2-3x more volatile, in fact. In layman’s terms, this means silver has much more price fluctuations and can be more ‘erratic’ than gold.

What type of jewellery should I invest in?

According to research, rings yield the best growth, followed by earrings, bracelets and then necklaces.

Avoid making these jewellery investment mistakes

I’ve shared an overview into the most popular and best yielding jewellery options, but now let’s take a look at jewellery you should avoid investing in. Because all that glitters is not a golden opportunity!

- Always buy your jewellery from an authentic, reliable supplier. Less reputable brands are known to offer gold-plated jewellery whilst labelling it as authentic fine jewellery. This will be easier to do in the UK, US and other countries where jewellery sale is regulated, but will be more difficult if you decide to purchase your jewellery from unregulated markets where the true quality of the jewellery is not disclosed.

- Ask for a certificate from the seller. This should detail the criteria of the jewellery to ensure you know what you’re getting.

- Gold-plated jewellery is not recommended. Gold-plated jewellery simply has a very thin layer of gold applied to the base metal. It rubs off quickly and thus loses it’s value rapidly. Opt for a high karat gold option instead.

- Go for simple, timeless pieces. Intricate patterns and trending designs may look attractive, however you may be spending a lot of money on the cost of craftsmanship and aesthetics. When it’s time to sell, those aspects don’t translate into an investment return.

- Consider coins as an investment piece if you won’t be wearing your jewellery. Coins do not require any craftsmanship and can be easily melted down.

- Have a plan for keeping your jewellery safe. If you grew up seeing your mother hide her jewellery under her mattress or in a suitcase under her bed, please know that this is not safe. Consider purchasing insurance for your jewellery.

I’d love to hear your thoughts about jewellery as an investment. Have you ever considered it for yourself before reading this post? Was jewellery a big thing in your family? Did you have any family heirlooms passed on to you? Please leave a comment and share your answers!

If you enjoyed this post and would like to see more money, business and finance tips from me, you can sign up to the Brown Girl Money email newsletter here (as well as getting my FREE Money Mastery Toolkit!) and you can also follow me on Instagram here. I’d love to see you there!

- The Complete Budgeting/ Financial Planning Toolkit

- The Ultimate 9-5 Escape Plan: How to Quit Your Job in 6 months

- Top 20 Side Hustle Ideas to Make £500 Per Month

- Investing Made Easy: Your 5 Step Guide to Start Investing Today

Get Your Money Mastery Toolkit

Snag £198 worth of bonuses completely free

You're all signed up!

Be sure to whitelist our email address so that all the goodies make it to your inbox.